The beauty category in 2025 has crossed the stage of trend-chasing. Competition is dense; consumer expectations are unforgiving; and the CAC landscape has reached a point where founders can no longer rely on guesswork. India’s market is swelling with ingredient-aware, value-conscious consumers, while the U.S. market is driven by transformation-first narratives and clinical credibility. To scale in both, a founder must design an engine that adapts not only to platform shifts and ad ecosystem changes but also to entirely different psychological motivations. Beauty brands that used to grow through broad targeting and discounted acquisition now find these approaches nearly obsolete. Success today requires precise funnel architecture, channel-specific creative development, full-spectrum retention, and data-backed strategy—competencies that define the modern D2C marketing agency every scalable beauty brand needs.

How to Scale a Beauty Brand in India & the USA (With Real 2025 Data & Ad Insights)

Introduction

Scaling a beauty brand in 2025 demands far more sophistication than most founders anticipate. India and the United States remain two of the fastest-growing beauty markets in the world, but their psychological, cultural, and platform dynamics could not be more different. What works in India often collapses in the U.S., and vice versa. The brands reaching multi-million ARR today are not the ones with the loudest influencers or the flashiest packaging—they’re the ones building systems: structured funnels, disciplined creative operations, retention frameworks, cross-market messaging, and a constant testing cadence. More importantly, these brands lean on our expertise as seasoned D2C beauty performance marketing agency that understands the pressures, realities, and opportunities of building across both markets simultaneously.

Why Scaling Beauty in 2025 Is Harder and Smarter

India vs USA Beauty Market: What’s Changing in 2025 (Tactical Comparison)

The Indian beauty consumer and the American beauty consumer behave like two separate species. In India, reassurance forms the backbone of decision-making: proof of safety, ingredient trust, real-people demonstrations, relatable results, value-based pricing, and strong review depth. The Indian consumer waits for validation—social proof matters deeply. Their journey usually involves Meta discovery → YouTube/Google research → website evaluation → Amazon for comparison and final trust check.

In the U.S., the narrative flips. The American buyer values transformation above reassurance. They want clarity: here is my issue, here is how this product fixes it, here is the evidence. Clinical claims, expert backing, dermatology cues, and strong before-after visuals drive conversions. And unlike India, where YouTube supports deeper education, U.S. discovery is overwhelmingly TikTok-first. Short-form authenticity, bold claims, and confident storytelling dominate.

These contrasts dictate everything—from pricing structure to messaging tone to creative angles. Trying to use one unified strategy across both markets is a costly mistake.

2025 Beauty Ads: What’s Actually Working (Directional Benchmarks)

The advertising landscape in 2025 requires founders to unlearn old habits. Meta has become more volatile: CPMs fluctuate aggressively, creative fatigue sets in quickly, and Advantage+ placements reward brands that maintain consistent creative variety. The ads that work today are layered with authenticity—raw UGC blended with clean product close-ups, strong hooks that acknowledge real skin concerns, and routine-led formats that subtly educate without overwhelming.

Google maintains its role as the “final decision” channel. Search behaviour in each market varies significantly, with India leaning toward “best, safe, natural, gentle,” while the U.S. favours “clinical, dermatologist recommended, effective.” Shopping ads, when paired with CRO-optimised landing pages, play a critical role in lowering blended CAC.

A major shift in 2025 is the rise of influencer licensing and whitelisting. Influencer content no longer lives only on their profiles; the real results come when brands run these posts as paid ads. Spark Ads, whitelisting, and creator licensing have overtaken traditional influencer collaborations. Beauty brands that integrate creators deeply into their paid strategy outperform those reliant on one-off posts.

Beauty Consumer Psychology (2025 Edition)

A beauty founder scaling globally must study consumer psychology as closely as product formulation. In India, beauty is tied to trust, routine, and reassurance. Indians want to know how to use a product, how long it will take to work, and whether it has worked for people with similar skin types. Social proof becomes a conversion accelerator, and ingredient transparency supports credibility.

In the U.S., beauty aligns with identity, confidence, and transformation. Consumers want visible change, expert validation, and strong storytelling that communicates a clear clinical advantage. Their tolerance for premium pricing is higher; their focus on authority is deeper. TikTok, with its raw authenticity and unfiltered reviews, has become the primary driver of impulse beauty purchases.

These behavioural differences shape everything: tone, visuals, scripts, CTAs, landing pages, and even offer design.

The Funnel That Actually Works in 2025 (Awareness → LTV)

The traditional three-layer funnel has evolved. In 2025, beauty brands rely on a narrative-driven, psychology-aligned funnel that begins at awareness and stretches through long-term retention. At the top of the funnel, the objective is to disrupt the user’s pattern—hooks that speak directly to a skin tension, emotional trigger, or transformation promise dominate. Awareness content must be raw, credible, and visually compelling.

Moving into consideration, the content shifts from attention to reassurance. This is where founder videos, testimonials, usage demos, and “reasons why it works” build confidence. In India, this layer is crucial; in the U.S., it accelerates conversion.

At conversion, the brand must eliminate all friction. Checkout clarity, money-back assurances, delivery timelines, trust badges, and crisp pricing justification all matter enormously. Many founders lose sales here due to missing reassurance.

But in beauty, the funnel does not end at purchase. Retention is the real profit driver. Email sequences, replenishment reminders, subscription pathways, and personalised recommendations form the backbone of sustainable scaling. LTV improves CAC, and CAC stabilises scale.

Paid Ads Strategy for 2025 (India & USA Beauty Brands)

Modern performance marketing requires structured creative operations, not random experimentation. Meta demands diversified storytelling—problem-solution scripts, routine-based demos, before-after visuals, and refined product close-ups. The targeting has become more simplified, but the creative expectations are higher. Brands that maintain 20+ active creatives consistently see more stable scaling.

Google supports the lower funnel. Search, Shopping, and branded protection work together to capture intent. For U.S. brands, Amazon becomes critical to reducing friction; for Indian brands, Google plays a heavier research role.

TikTok remains the most influential platform in the U.S. Scaling depends on authenticity, speed of iteration, and a willingness to test many small bets. The brands winning on TikTok are not the ones with polished content—they’re the ones with fast testing loops and strong creator relationships.

This strategic approach aligns with Google Ads vs Meta Ads in 2026: Which Platform Gives Better ROI for D2C Brands?, where we analyze how different platforms can be leveraged based on creative and targeting strategies. Similarly, How to Scale a Home Decor Brand in India & the USA with Real Market Benchmarks highlights the importance of using structured creative operations to drive successful cross-market growth.

Budget Allocation Framework for Beauty Brands

India and the U.S. require different budget philosophies. India sees best performance with Meta-heavy allocation complemented by strong UGC volume and high-velocity static testing. Google provides stability but not dramatic scale.

In the U.S., the spend naturally distributes between TikTok and Meta, with Google and Amazon stabilising intent. Founders who treat India and U.S. budgets similarly often face unpredictable CAC and weak LTV alignment.

A specialised agency builds two separate growth engines rather than forcing a unified approach.

Influencer & Creator Ecosystem Strategy (2025)

Creators are no longer optional—they are the fuel that keeps funnels alive. India benefits from a wide base of nano and micro creators who offer cost-efficient UGC that amplifies relatability. These creators help brands build large UGC libraries that strengthen paid ads and lower acquisition costs.

In the U.S., creators command higher prices but drive sharper impact. TikTok-first creators especially influence buying decisions. The shift toward creator licensing means that brands must integrate influencers directly into paid distribution to extract full value. The result is a more authentic, conversion-ready ad library.

Omnichannel & Retail (The 2025 Reality)

Retail is not a relic; it is a credibility amplifier. In India, offline partnerships boost trust, sampling, and familiarity. Consumers feel more confident buying a product online when they’ve seen it offline. In the U.S., retail placement enhances perceived legitimacy. For beauty brands, retail elevates brand status even when most sales remain online.

Retention, LTV & CRM: The Systems That Create Real Scale

Beauty is an LTV-first category. The brands achieving consistent profitability are those whose retention systems run quietly but powerfully in the background. Email flows that educate and nurture, SMS/text sequences that reconnect with customers, replenishment-based logic, subscription variants, and bundle strategies all form the foundation of stable growth. Retention is no longer a “post-purchase” tactic—it is the strategic engine that makes acquisition affordable.

Founder Mistakes to Avoid in 2025

The biggest mistakes beauty founders make today are structural, not creative. They rely on a single platform for acquisition. They underinvest in testing. They produce too few creatives. They use identical messaging for India and the U.S. They skip landing page optimisation. They lack a clear retention engine. They treat creators as optional. They chase discounts without building brand value. All of these mistakes stem from not building a complete system.

The Actionable Founder Playbook (Step-by-Step For India & USA)

A beauty brand ready to scale must refine its positioning, build a disciplined creative OS, construct a multi-layer funnel, develop a creator ecosystem, establish a retention system, and expand omnichannel with intention. These steps require consistency and execution rigor—not guesswork. This is precisely where a specialised D2C performance marketing agency steps in. Scaling two vastly different markets cannot be done with a single fragmented in-house team; it requires a partner who understands both ecosystems deeply.

Why Beauty Brands Scale Faster With the Right D2C Agency Partner

India and the U.S. are dual universes. Their psychology, platforms, pricing, and consumer paths differ radically. A skilled growth partner—the right D2C marketing agency or best D2C agency India with cross-market experience—brings the frameworks, creative testing systems, retention expertise, and market-specific strategy that accelerate scale. HavStrategy’s approach is built exactly on these principles: market-tailored funnel systems, creator integrated pipelines, ad architecture engineered for beauty, and retention models designed to improve LTV across regions.

Conclusion — 2025 Belongs to Beauty Founders Who Build Systems

Beauty founders who win in 2025 will be the ones who approach growth as a system—not a campaign. The Indian and American markets offer extraordinary scaling potential, but only for brands that master their psychological differences, creative rhythms, performance architecture, and retention ecosystems. And for founders ready to grow across both regions, working with a specialised partner like HavStrategy can transform scattered efforts into a predictable, scalable engine.

HavStrategy is one of the best D2C performance marketing agencies specifically for beauty and lifestyle brands operating across India and the U.S. Our approach isn’t built on guesswork, it’s built on data, funnel discipline, creative science, and deep understanding of dual-market consumer psychology. We design full-stack growth systems: market-correct positioning, high-velocity creative operations, Meta + Google + TikTok performance architecture, influencer licensing frameworks, retention and LTV ecosystems, CRO-optimised landing experiences, and omnichannel strategies.

Whether it’s scaling an India-first brand into the U.S. or helping a U.S. brand establish trust and consistency in India, HavStrategy builds the exact infrastructure modern beauty brands need ie performance engines that compound, not campaigns that burn out. For founders serious about long-term scale, profitability, and cross-market domination, HavStrategy becomes the unfair advantage behind the brand.

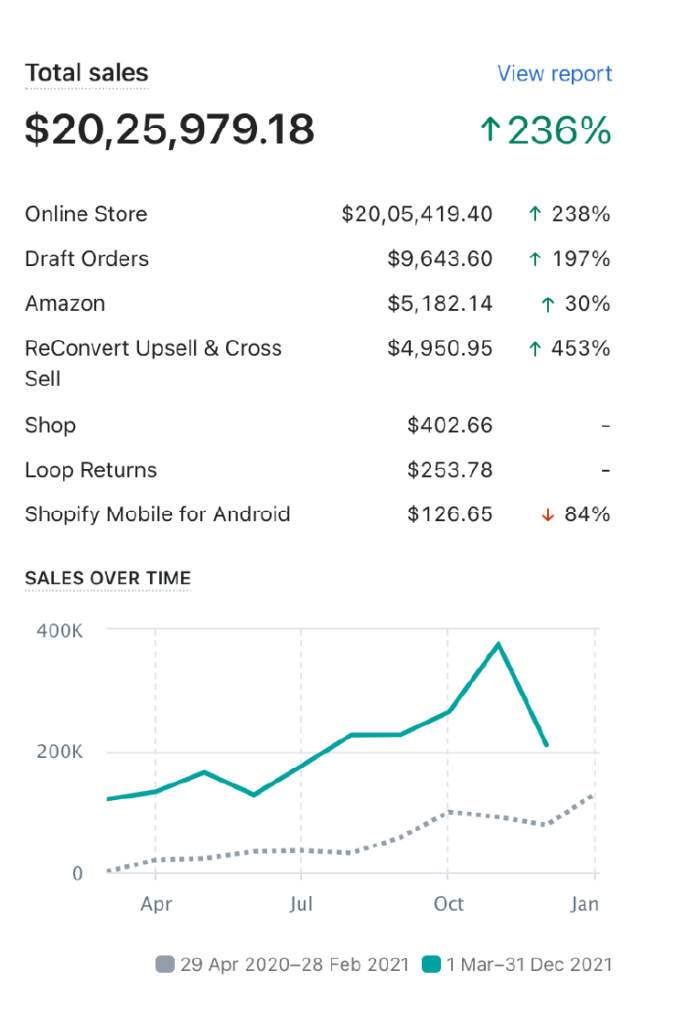

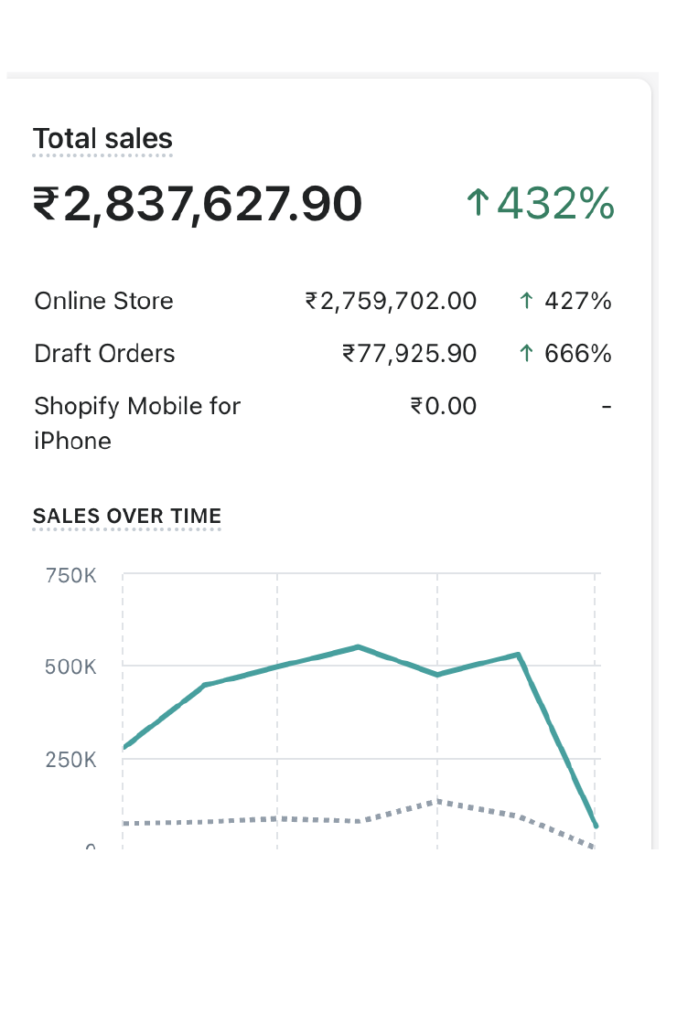

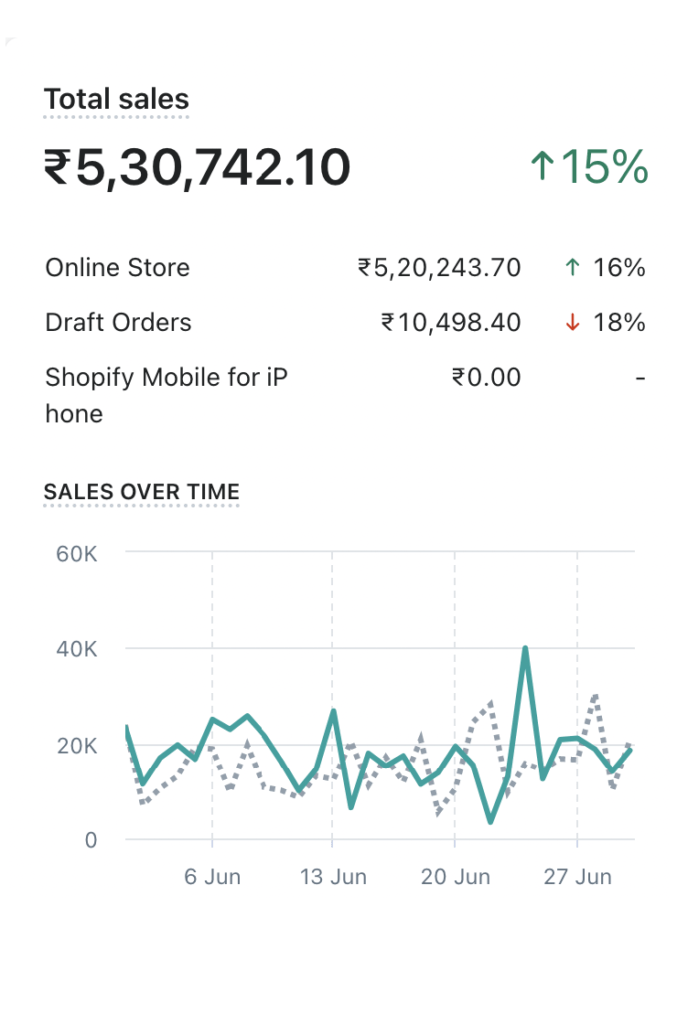

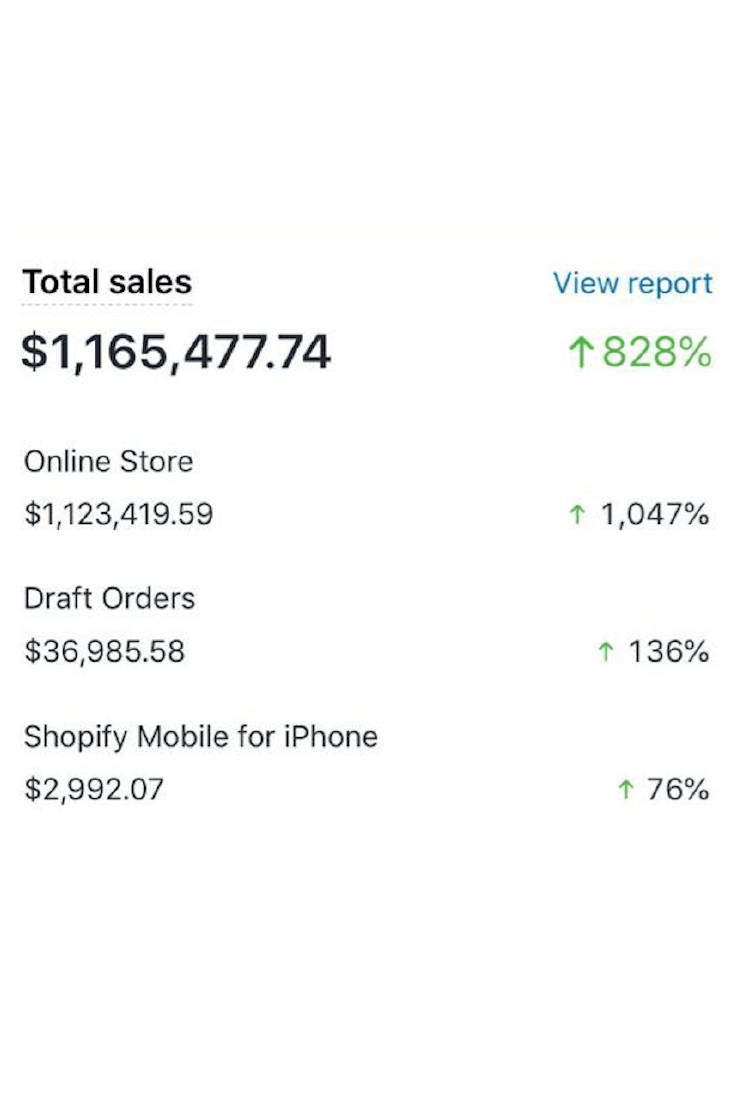

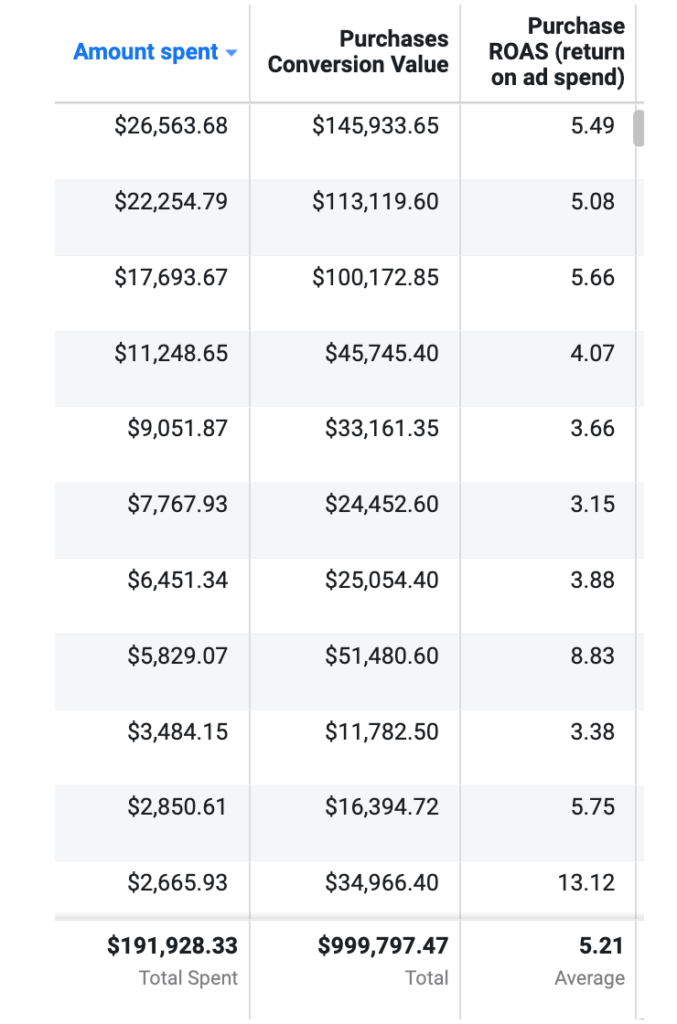

Past Results From Our Beauty Brands

Let's increase your revenue together!

Get Results For your Beauty brand In First 3 Months

Want Us To Be The Growth Partner To Your Business?

As Seen On

Let's Connect

Industries

International Market

Fashion Marketing Agency in UK

Fashion Marketing Agency in UAE

Lifestyle Marketing Agency in UAE

Skincare Marketing Agency in UK

Cosmetic Marketing Agency in UK

Beauty Marketing Agency in UAE

Luxury Marketing Agency in UAE

Home Decor Marketing Agency in UK

Home Decor Marketing Agency in UAE

Services

Social Media Marketing Agency in UK

Social Media Marketing Agency in UAE

Performance Marketing Agency In UK

Performance Marketing Agency In UAE

Digital Marketing Agency In UK

Digital Marketing Agency In UAE

Home Decor Marketing Agency In Australia

Beauty Marketing Agency In Australia

Skincare Marketing Agency In Melbourne

Fashion Marketing Agency In Australia