Even though both regions represent massive demand for home décor, they operate with entirely different mindsets. In India, the home décor category is moving from emerging to aspirational maturity. Consumers want to elevate the look of their home and are visually influenced by platforms like Instagram and Pinterest. Their purchase decisions lean heavily on inspiration, novelty and the idea of upgrading their homes. The Indian customer scrolls through décor influencers, saves room-styling content, follows interior designers casually and often buys when inspiration aligns with price justification. Delivery expectations in India are rising, but there is still a degree of tolerance as long as communication remains strong.

In the United States, the home décor market is deeply mature, structurally competitive and strongly influenced by years of developed consumer literacy. The American consumer is research-driven, compares options extensively, checks materials, reviews, warranty details and customer experiences before making a purchase. They explore platforms like Pinterest, TikTok, YouTube and home makeover shows long before they consider buying anything. Visual inspiration matters, but trust and reliability matter much more. Delivery expectations are firm, and strong post-purchase communication is non-negotiable.

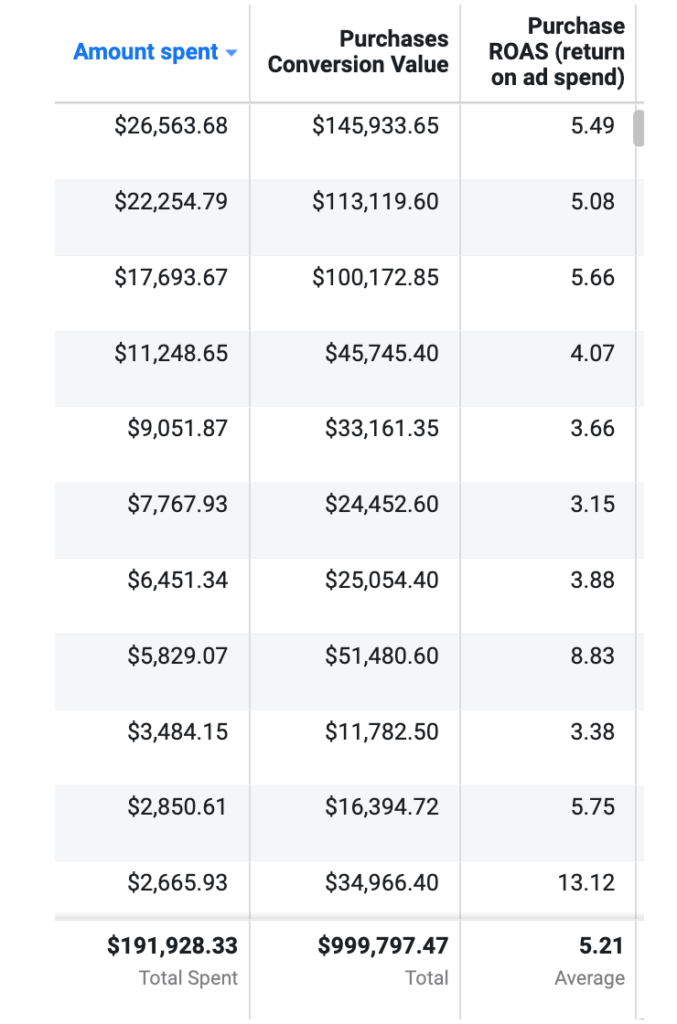

The India–USA comparison becomes even sharper when directional benchmarks are considered. CPMs are almost always higher in décor compared to other lifestyle segments because aesthetic content faces intense competition. CTR remains healthy across both markets because décor inherently attracts clicks. Conversion requires trust-building—far more than in clothing or beauty—because the customer cannot feel the product physically. AOV is naturally higher in home décor, but so is CAC. This is why founders must accept that ROAS does not behave like a low-ticket category. Instead, the growth model relies on blended profitability and retention-driven economics. As the best D2C agency India partners with multiple lifestyle brands, it becomes clear that high-AOV categories depend heavily on multi-touch storytelling. The American market shows stronger repeat behavior due to mature décor habits, while the Indian market shows seasonality tied to festivals, home upgrades and aspirational milestones.